Second-order thinking is about looking beyond the immediate, obvious consequences of a decision and considering the ripple effects – the consequences of the consequences, and even the underlying assumptions that lead us to those initial thoughts. It’s about asking “And then what?” repeatedly, and challenging the “taken-for-granted” beliefs (presuppositions) that often guide our first-order thinking. You can explore this concept further and apply it to your own decision-making using tools like the AI Assisted Decision Making app.

Let’s use the example of financing your studies:

First-Order Thinking:

You might initially think: “I need money for my studies. A student loan is available. Therefore, I will take a student loan.” This is a straightforward, immediate solution to an immediate problem. The presupposition here is often “student loans are a standard and necessary way to fund higher education.”

Second-Order Thinking (and uncovering presuppositions):

A second-order thinker would then ask: “And then what if I take a student loan?”

- Consequence 1: I’ll have the funds to enroll in my desired modules and continue my degree.

- And then what? I’ll be able to complete my degree, which could lead to better job prospects.

- And then what? I might earn more money, but I’ll also have the burden of loan repayments.

- And then what? Will the increased income truly offset the mental and financial stress of debt? What if job prospects aren’t as good as anticipated? What if my personal circumstances change?

- And then what? I might earn more money, but I’ll also have the burden of loan repayments.

- And then what? I’ll be able to complete my degree, which could lead to better job prospects.

- Consequence 2 (uncovering a presupposition): Taking a loan means incurring debt.

- And then what? This debt will accrue interest over time, potentially becoming a much larger sum than I initially borrowed.

- And then what? This could impact my ability to save for other life goals (e.g., buying a home, starting a family, retirement).

- And then what? My financial freedom in the future might be significantly constrained.

- And then what? This could impact my ability to save for other life goals (e.g., buying a home, starting a family, retirement).

- And then what? This debt will accrue interest over time, potentially becoming a much larger sum than I initially borrowed.

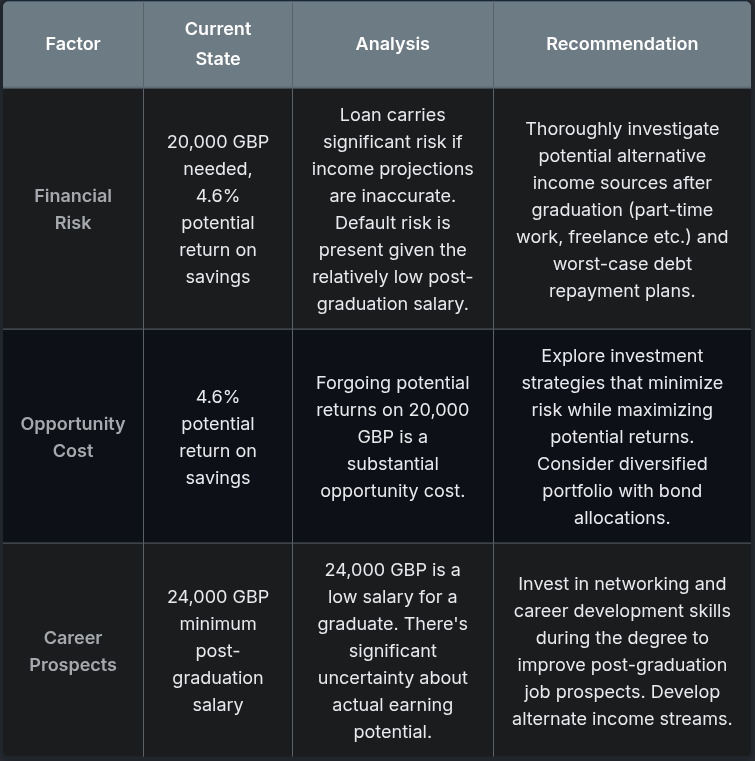

Here, the second-order thinking helps you challenge the initial presupposition that a student loan is the only or best path. By digging deeper, you might uncover a new line of thought: “What if I use (some of my) personal savings instead?” This leads to a different set of consequences and, potentially, a more favorable long-term outcome, even if it requires a different immediate approach.

The presupposition that “student loans are the default” or “I must take a loan to study” is examined and potentially overturned when you consider the deeper, long-term implications. You shift from simply reacting to the immediate problem to proactively shaping your future financial landscape.

Screenshot from the Mental Models App.

Three Key Takeaways:

- Go Beyond the Obvious: Second-order thinking encourages you to move past the immediate solutions and explore the wider, often hidden, consequences of your decisions.

- Challenge Your Assumptions (Presuppositions): Many decisions are based on underlying beliefs we don’t consciously examine. Second-order thinking helps you identify and question these “taken-for-granted” notions, opening up new possibilities.

- Think “And Then What?”: This simple question is the core of second-order thinking, prompting you to trace the chain of effects and consider how a decision today might play out weeks, months, or even years down the line.

Written for the Mental Models App by Hyper Lexia — may your decisions be as sharp as your curiosity.